Monthly Business Budget

Maintaining a budget is especially important when running a business. Whether you offer goods or services, this monthly budget template can help put you on the road to success. Record business expenditures, such as advertising, taxes, and legal fees, and plot them against business income, such as product sales and service fees. This template shows you where you need to reduce or eliminate spending, and helps you identify your most profitable sources of income.

Download Monthly Business Budget

Household Monthly Expense Budget

When you have a house full of people, tracking expenses can get complicated. Monthly budget spreadsheets are helpful when managing spending for your family or roommates. This template gives you a close look at your household’s planned versus actual income and details expenses for individual categories on a monthly basis. Carefully tracking this information will help you better meet financial goals, prepare for emergencies, and plan for the future.

Download Household Monthly Expense Budget

Personal Budget

Setting a budget for yourself is hard — and following it can be even harder. Using monthly budget sheets helps make it easier. This detailed template offers a summary of your income, expenses, and savings goals (both in aggregate and by month) on one sheet with a detailed monthly breakdown by category on another. By taking a closer look at your budget, you can gain better control over your finances.

Download Personal Budget

Department Budget

This monthly budget sheet can help you forecast expenses for your business or academic department for the entire fiscal year, as well as by month. You can also compare percentage changes in the budget from year over year. Expenses are grouped by category (for example, website, research, and travel costs) to give you a snapshot of how you’re allocating department funds.

Download Department Budget

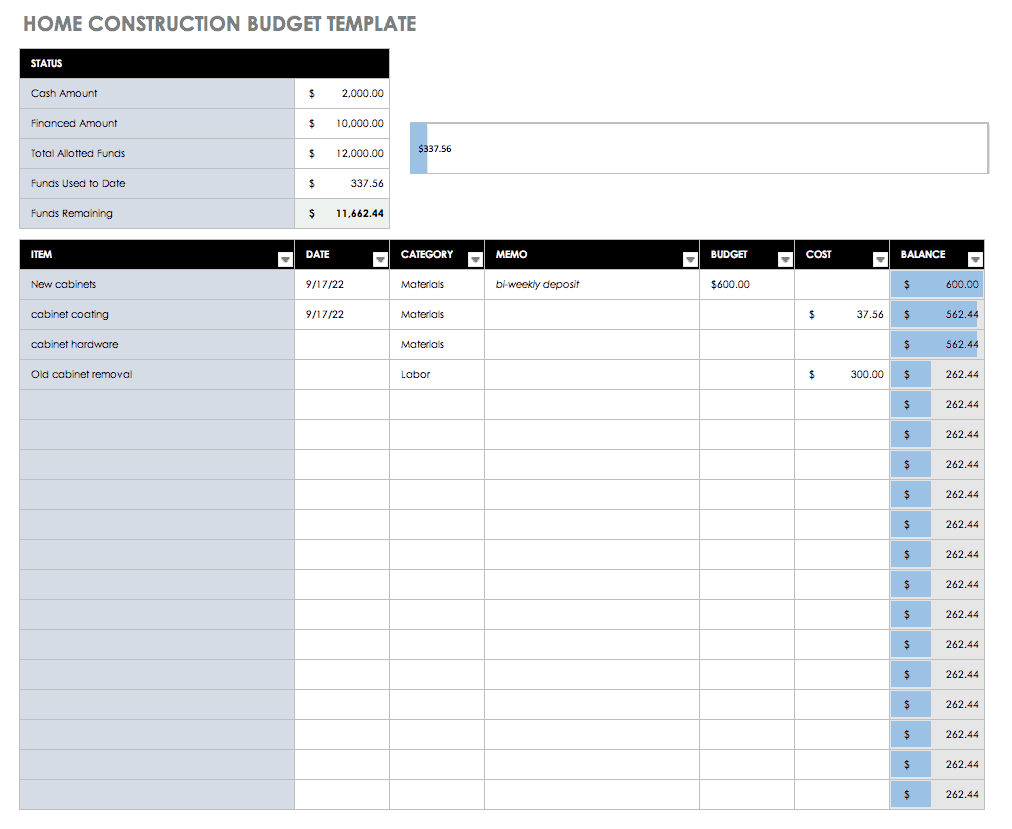

Home Construction Budget

Whether remodeling your home or building a new one, it’s easy for costs to get out of hand. Use this monthly budgeting worksheet to account for all labor and materials expenses, track spending by category, and ensure you’re within your overall budget. This template can also help you set aside extra funds for emergency repairs and unforeseen costs, which are common with construction projects. Check out theseExcel construction management templatesto help you manage a budget for larger jobs.

Download Home Construction Budget

Simple Monthly Budget

If you just need a basic budget tracker, or if you’re making a budget for the first time, this simple budget template can help you get organized. It offers a basic snapshot of your income, expenses, and insight into extra money that you can save. You can also use this template to plot your finances on a chart for an at-a-glance look at your spending.

Download Simple Monthly Budget

Academic Club Budget

This monthly budgeting sheet helps you track income and expenses for an academic club. Clubs often have annual goals for fundraising, dues, or sponsorship, as well as limits on monthly and annual spending. Tracking all this on a monthly budget planner can help you gauge progress toward financial goals, and verify that your club isn’t spending more than it’s making.

Monthly Budget Calculator

Using this basic budget calculator, you can quickly and easily plot regular expenses for major categories (housing, transportation, debt, etc.) against your income for the month. Simply plug in the payment and receipt amounts, and the calculator will reflect totals in aggregate as well as by category for the month. This gives you an at-a-glance view of how closely you’re sticking to your budget.

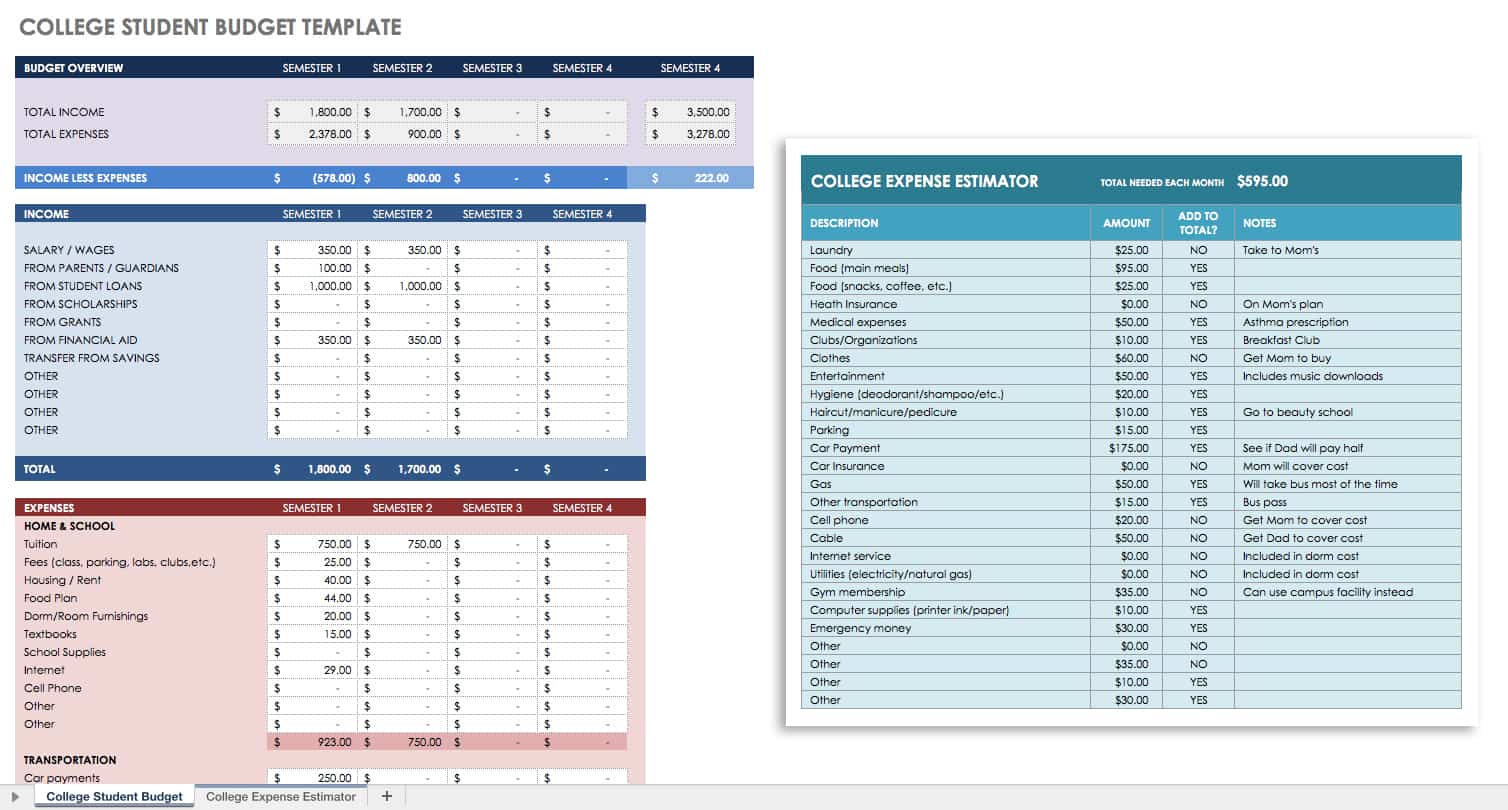

有限公司llege Student Monthly Budget

有限公司llege is one of the biggest investments many people will make in their lifetime. Use this monthly budget Excel spreadsheet to help plan for it accurately. In addition to tuition fees, this sheet will help you track spending on textbooks and educational supplies, housing, and transportation, as well as income from jobs, internships, and student loans or scholarships. You can also track your college budget by month or by quarter.

Download College Student Monthly Budget

Early Retirement Budget Sheet

com提前计划尤其重要es to your retirement. If income and expenses aren’t tracked and distributed properly, it could seriously impact your future. Using this monthly budgeting worksheet, you can ensure you’re financially secure when you retire. Track income sources as well as living, personal, and medical expenses on a weekly, bi-weekly, quarterly, or annual basis. You can also compare your actual income with what you need to retire comfortably.

Monthly Family Budget Planner

Families have a lot of expenses. From doctor’s visits to vacations to saving for college, you need a comprehensive budget to track your family’s spending. This monthly budget worksheet allows you to compare expenses with your family’s income and savings, and reflects annual totals by category. Using this template, you can make sure your family is financially prepared for future expenditures, such as education and retirement, as well as for any emergencies that may arise.

GLBL Monthly Budget Spreadsheet

如果你想要更细粒度的控制你的财务状况,this “Gather Little by Little (GLBL)” budget template is for you. It allows you to designate every dollar of income you receive from your paycheck for a specific purpose, so you can avoid spending more than you’re making. This comprehensive monthly budgeting worksheet offers an at-a-glance view of all expenses and income on one sheet, and breaks down each spending category in detail on the following sheets in the template.

K-12 School Expense Budget Template

Even before your kids reach college, school expenses can add up. Keep track of them with this monthly budget template. It allows you to track all spending related to school and extracurricular activities: tuition, lab fees, books and school supplies, uniforms, club and team dues, and more. By managing your school budget, your kids will have the financial support they need to achieve their goals.

Monthly Budget Template

This all-purpose monthly budgeting spreadsheet can help you keep track of most personal and family expenditures. Use this template to enter housing expenses such as rent, utilities, and telephone; recurring payments such as car loan, insurance, and credit card charges; food and drink expenses; and other costs of living, such as child care, gym memberships, and entertainment. These can be tracked against your individual and/or family income, so you can make sure you’re prepared for the future.

Zero-Based Budget Spreadsheet

Similar to the GLBL budget spreadsheet, the zero-based budget involves distributing your income to certain expense categories, so the balance equals zero at the end of each month. Whether you’re allocating money to living expenses (housing, car, groceries, etc.), to fun and entertainment, or to save for the future, a zero-based budget sheet will tell you where each dollar is going. Use this spreadsheet to plot your current income against your expenses, and adjust your budget until it zeroes out.

有限公司mpleted Sample Budgets

Need some more help getting started? These templates offer an example of what your budget might look like once it’s complete. No matter how great your income, planning ahead is important so you don’t overspend, or spend too much in the wrong place. Easily compare your own spending against these sample low-income and high-income budgets to see if you’re on track or need to make adjustments.

How to Use a Budget Template

To create your budget, first determine your regular income: for example, paychecks, government assistance, alimony payments, and child support. Businesses should consider how much money is allotted for specific projects. Don’t count irregular income, such as bonuses or gifts, since these fluctuate from month to month.

Next, calculate your regular expenses. Include everything from housing costs to insurance premiums to recreational spending. For variable expenses, such as utility bills, calculate your monthly average. Don’t forget to include things like groceries, gym memberships, and regular ATM withdrawals.

Finally, choose and download the right budget template and use it to plot all of this information - make sure your spending doesn’t exceed your income. You can also track your finances on an even deeper level by downloading and using one of ourweekly budget templates.

Create a Monthly Budget in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time.Try Smartsheet for free, today.